HOUSE INSURANCE IN NIGERIA

INTRODUCTION

In general, insurance is an arrangement by which a company

or the state undertakes to provide a guarantee of compensation for specified

loss, damage, illness, or death in return for payment of a specified premium.

House Insurance Policies in Nigeria

The public building liability insurance, is one of the five

compulsory insurances stipulated by the insurance Act 2003 but which has been

dormant without implementation. Yet, cases of collapse buildings and

destruction of lives and properties for which it is meant to protect occur

every day.

When you sign up for a policy in Nigeria, your insurer will

charge you a premium. This is the amount you pay for the policy or the total

cost of your insurance – as we have established. In Nigeria, an insurance

company would require you to pay the premium in instalments; either monthly or

semi-annually.

How to insure your new house in Nigeria

Home insurance may not be so popular among Nigerians, but

the recent increase in the rate of building collapse in most parts of Nigeria

and the monumental damage to homes by floods and other natural disasters call

for an urgent need to insure your house, new or old.

It is therefore imperative for the individual to carry out

his/her own evaluation to know how much it will take to rebuild their house in

the event of damage or destruction.

An added advantage of your home insurance policy is the fact that it covers the replacement value. Do check the policy properly before endorsing it to ensure that smaller items like your fence, gate, electric/water supply system, bathroom, kitchen and other interiors are covered in the policy. It must be noted however that the more the coverage, the higher the premium policy, so be prepared for it.

Clarification

There is a difference between a house holder policy and a

home owner policy. The house owner policy only covers a private residence or a

rented apartment. Some will say, “Insurance for rented apartment?” Why can’t

one have a house holder policy, considering the fact that you may have valuable

things inside your rented apartment.

2 types of house insurance in Nigeria

Home insurance – A house is the biggest investment most

Nigerians make, so it is important that it is insured. You can pay a bit extra

to obtain guaranteed replacement coverage, which mandates that the insurer will

replace your home if it is destroyed. If you only specify a certain amount of

coverage, you could end up paying the difference if it doesn’t meet all your

replacement expenses.

Homeowner’s insurance – This helps protects your movable

assets including devices like laptops and mobile phones. Items covered under

this policy are covered if they are damaged or stolen even outside your

home/premises.

HOME OWNERS' INSURANCE GUIDE

Homeowners insurance (also known as home insurance) isn't a luxury;

it's a necessity. And not just because it protects your home and possessions

against damage or theft. Virtually all mortgage companies require borrowers to

have insurance coverage for the full or fair value of a property (usually the

purchase price) and won't make a loan or finance a residential real estate

transaction without proof of it.

KEY TAKEAWAYS

Homeowners insurance policies generally cover destruction

and damage to a residence's interior and exterior, the loss or theft of

possessions, and personal liability for harm to others.

Three basic levels of coverage exist: actual cash value,

replacement cost, and extended replacement cost/value.

Policy rates are largely determined by the insurer's risk

that you'll file a claim; they assess this risk based on past claim history

associated with the home, the neighborhood, and the home's condition.

In shopping for a policy, get quotes from at least five

companies, and definitely check with any insurer you already work with—current

clients often get better deals.

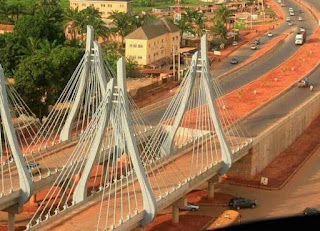

OUR ESTATE LOCATION:

Abuja, Asaba, Enugu, Uyo, Calabar, Port Harcourt, Ibadan, Benin, Warri, Osogbo, Ota, Awka, Owerri, Umuahia, Abakaliki, Epe, lagos, Abeokuta, Ogun and nationwide

SMS, Call or WhatsApp: 07030765952

bikejoseph@gmail.com

https://joenigeria.blogspot.com

For DailyProperty listing In Uyo

For our products and services

For updated landlistings nationwide

For more information about Joe Nigeria

IBOM E-LIBRARY provides the following rentals services: Conference hall for meetings, summits, workshops, seminars etc. We also have office spaces, Board rooms, a CBT centre, academic and Outdoor spaces for rent Location: Along IBB Way Uyo. Contact: 07030765952

Comments

Post a Comment