5 THINGS EVERY PROPERTY INVESTOR SHOULD KNOW

Purchasing an investment property differs from

purchasing a family house. This is a common blunder made by persons planning to

enter the industry. Just because you've already made an investment in a

property doesn't guarantee you understand what it's like to invest in the real

estate market or how to profit from it.

For a family home, consider the possibilities

for future family expansion, personal preferences, and your long-term goals

(both career- and lifestyle-wise). All you have to worry about with an

investment property is the return on your investment.

However, like with any new venture, it's

critical to conduct thorough study on the subject of property investment before

getting started.

The route to riches in real estate investing

does not come with a map, and it is often meandering. However, there are steps

you can do to put yourself on the right track and increase your chances of

success. It's a good idea to start by listening to real estate pros and

successful investors.

That's why we've put up this comprehensive guide

to real estate investing, complete with 5 must-know property investment tips

for any investor.

If you're not sure where to start when it comes

to property investing, stay reading for simple and helpful property investment

advice.

1, Make sure you're prepared and aware of the

dangers.

It goes without saying that you should know

exactly what you're getting into in terms of risk before embarking on any new

business, especially one as significant as purchasing an investment property.

Property, like every other enterprise, entails

certain risk. This isn't to say that you shouldn't invest in real estate. The

greatest risk of all is failing to take one.

So, what are the fundamentals and hazards of

property investment that you should be aware of?

Simply put, the two risks associated with

property investment are the property market and the renters that use your

property.

2, Have a plan for investing

Knowing what you want to achieve and figuring

out the steps to get there is the easiest way to express the concept of having

an investment strategy. This is no exception in the realm of real estate

investment. While you can build your own effective investment plan, your

chances of doing so while you're still a novice investor are slim. Fortunately,

there are a number of tried-and-true methods you can employ. Any of these could

help you ease into the world of property investment and give you a better

understanding of what you're doing.

3, Know How to Make a Profitable Property

Investment

You've probably come across the term 'lucrative

investment' if you've spent time reading up on property investment ideas and

are now seeking information in property investment guides.

And, of course, every property investor hopes to

profit from their investment. However, you may be wondering:

What makes a property investment profitable?

Isn't it possible to merely buy the first property that appeals to you and

anticipate huge returns?

If you want to ensure that your property

investment venture succeeds, keep the following pieces of property investment

advice in mind.

When Is the Best Time to Buy?

When it comes to property investment, timing is

important. When the market is performing well, it is the ideal time to purchase

an investment property.

So, what exactly does this imply?

If you're buying a rental property as an

investment, you'll want to do so when:

House prices are low, which means there are some

good investment options.

In the following years, property values are

expected to climb.

The rental market is booming, with high demand

for rental properties.

Care About Capital Growth

A rise in the value of a property over time is

referred to as capital growth in property investment. Property prices usually

increase in value over time. Due to a variety of causes, this growth may be

higher than usual in some cases.

Two of the most common causes of capital

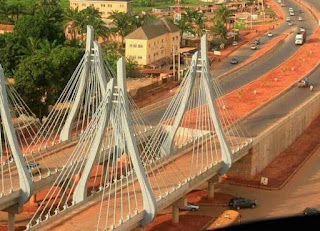

expansion are regeneration and market demand. That is why so many individuals

invest in Lagos, as the city's continual regeneration provides excellent

capital growth opportunities.

When looking for a property to invest in, be

sure to pay particular attention to the possibility for capital growth.

4, Employ a hiring manager

This individual is critical to the success of

your investment strategy, as they will be in charge of concerns such as rental

property maintenance, tenant relations, and more. They serve as a buffer

between you and the renter, which can be a significant asset or advantage.

Finding a great property manager early on is also crucial, since it may

encourage you to buy multiple properties in the same city rather than

dispersing your real estate assets across the country.

5, Begin your investment journey with cheaper

properties.

In any industry, experience is essential for

success, yet gaining experience takes time. When it comes to investing, whether

it's in real estate or stocks, you should never put more money into them than

you're willing to lose. The benefit of investing in real estate is that the

value of the property can never truly be zero. You can also move in there even

if you are unable to sell the property; nevertheless, you may be able to

acquire a lease on it. To make your investment a little safer, seek for the top

cities to invest in for real estate novices, which will help you narrow down

your search for the perfect real estate property.

BOTTOM LINE

Real estate can assist you in diversifying your

investment portfolio. Real estate has a poor correlation with other main asset

classes in general, so when equities fall, real estate often rises. A sound

investment in real estate can provide consistent cash flow, significant

appreciation, tax advantages, and competitive risk-adjusted returns.

Of course, before investing in real estate, you

should examine certain variables, such as the ones described below, just like

you would with any other investment.

By Wale Akinpelu

Further Reading:

10 habits of real estate investors, Five mistakes new investors should avoid

OUR ESTATE LOCATION:

Abuja, Asaba, Enugu, Uyo, Calabar, Port

Harcourt, Ibadan, Benin, Warri, Osogbo, Ota, Awka, Owerri, Umuahia, Abakaliki, Epe, lagos, Abeokuta, Ogun and nationwide

SMS, Call or WhatsApp: 07030765952

bikejoseph@gmail.com

https://joenigeria.blogspot.com

For DailyProperty

listing In Uyo

For our products

and services

For updated landlistings

nationwide

For more information about

Joe Nigeria

IBOM E-LIBRARY provides the following rentals

services: Conference hall for meetings, summits, workshops, seminars

etc. We also have office spaces, Board rooms, a CBT centre, academic and

Outdoor spaces for rent Location: Along IBB Way Uyo. Contact: 07030765952

Comments

Post a Comment