TAXES APPLICABLE TO REAL ESTATE IN NIGERIA

What is Tax?

- Stamp Duties Tax

The Stamp Duties Act requires that all written instruments, including instances where any property or interest in a property is or are transferred or leased to any person, must be stamped. Any written document to that effect that is not stamped is not allowed to be received in any judicial proceeding in Nigeria until the stamp duty and the resulting penalty for the non-payment of the stamp duty is paid. There are fines and other penalties for any failure to pay stamp duties on any written instrument that is not exempted from the payment of stamp duty.

- In Lagos State, the flat Stamp Duty rate of 2% of the consideration of the property transaction is charged when applying for Governor's consent to the transfer of any interest in a landed property.

- Companies Income Tax

- Any income with the resulting profit earned by a corporation from a property transaction is liable to the payment of tax. The corporate tax rate in Nigeria is thirty per cent (30%) of the annual profit of the corporation.

- Personal Income Tax

- Any income with the resulting profit earned by any person from such income, from a property transaction, is liable to the payment of tax. The graduated tax rate is twenty-four per cent (24%) for individuals earning Three Million, Two Hundred Thousand Naira (N3,200,000.00)and above, per annum.

- Education Tax

- In addition to paying Companies Income Tax, incorporated corporations in Nigeria, engaged in any commercial activity, including real estate or real property transactions from which they make a profit, are liable to pay two per cent (2%) of such profit as Education tax to the Education Trust Fund. This Tax is collected on behalf of the Education Trust Fund by the Federal Inland Revenue Service ("FIRS").

- Value Added Tax

- All goods and services in Nigeria, including goods and services utilized in the real estate industry, are liable to be invoiced and to the payment of Value Added Tax ("VAT") at the rate of five per cent (5%) of the value of such real estate goods and services. All taxable persons are required to ensure that within six months of their commencing business, they are registered for VAT, and mandatorily file monthly VAT returns. Any failure to register for VAT, or to collect VAT, or to issue a VAT invoice, etc. is an offence that entitles the Federal Inland Revenue Service ("FIRS") to assess the taxpayer for the VAT payable based on FIRS' best judgment of the VAT that is liable for payment. This is in addition to fines and interest at commercial interest rates on the unpaid VAT. The decisions of FIRS are however subject to further appeals where the taxpayer disputes any decision of FIRS.

- Lagos State Land Use Charge

- The Annual Charge Rates Notice, published in furtherance of the Land Use Charge Law, among other things, prescribes various Land Use Charge Rates for different kinds of properties in Lagos State.

- Owner-occupier properties occupied by pensioners, family compounds, properties occupied by recognized traditional rulers, public libraries, cemeteries and burial grounds, and properties owned and occupied by a religious body but used exclusively for public worship or religious education, are exempted from the provisions of the Land Use Charge Law.

- There are stiff penalties for failure to pay a property land use charge within the period stipulated in a LUC Demand Notice. In additional to fines, a defaulting taxpayer can have his property brought under receivership, advertised and sold to defray all outstanding taxes, penalties and administrative charges resulting from the default to pay this property tax.

Lagos State Governor's Consent – Property Taxes

- In addition to the above stated flat rate of 2% as Capital Gains Tax and 2% as Stamp Duties Tax, a new owner of real property in Lagos State will also be liable to pay 3% of the accepted consideration of the property as a Registration fee, and a further 8% of the value of the property as Governor's consent fee.

- Conclusion

There are various penalties for the non-payment of Property Tax, in addition to fines for non-compliance, obstruction and rendition of false property tax returns, other penalties include the sale of the subject property to defray any unpaid Property Tax and Fines. Properties that are exempted from paying tax include; those that are owned occupied and used by religious bodies exclusively for religious or congregational worship, education or such similar purpose, Non-profit making cemetery or burial grounds, public parks, diplomatic premises and real property used strictly by public institutions for learning or education.

As a guide only, it is always advisable to contact the Land Use Charge Office of your state for a definitive assessment of your property.F

Further reading: see globalpropertyguide

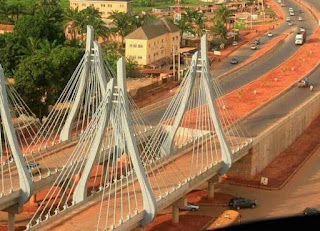

OUR ESTATE LOCATION

Abuja, Asaba, Enugu, Uyo, Calabar, Port Harcourt, Ibadan, Benin, Warri, Osogbo, Ota, Awka, Owerri, Umuahia, Abakaliki, Epe, lagos, Abeokuta, Ogun and nationwide

SMS, Call or WhatsApp: 07030765952

bikejoseph@gmail.com

https://joenigeria.blogspot.com

For DailyProperty listing In Uyo

For

our products and services

For

updated landlistings nationwide

For more information about Joe Nigeria

IBOM E-LIBRARY provides

the following rentals services: Conference hall for meetings, summits,

workshops, seminars etc. We also have office spaces, Board rooms, a CBT

centre, academic and Outdoor spaces for rent Location: Along IBB Way Uyo.

Contact: 07030765952

Comments

Post a Comment