THE SKYE SHELTER FUND IN NIGERIA

The Skye Shelter Fund (The Fund) is a close-ended Real Estate Investment Trust Scheme. The Fund is intended as a platform for pooling resources together from various classes of investors interested in exploring investment opportunities in the real estate sector. The target investors are typically Pension Fund Administrators, Investment Managers, Endowment Funds, Insurance Companies, International Investors, and Savvy Individual Investors interested in the stability and returns associated with Real estate investing.

The Fund is dedicated to utilizing a pragmatic research-driven approach to acquiring, holding, renting, renovating and/or trading income-generating real estate, such as residential homes, shopping malls, shops, hotels, offices and warehouses while taking advantage of The Fund’s tax exempt status.

The Skye Shelter Fund has continued to record significant performance. The Fund is the first Real Estate Investment Trust (REIT) in Nigeria listed on the Nigeria Stock Exchange (NSE). The Fund started through an Initial Public Offer of 20 million units of N100.00 each on 23 July 2007 and was officially listed on the Nigerian Stock Exchange on 28 February 2008 at a price of N100.00 The Fund closed the year at a price of N111.01, recording a resilient 11% capital appreciation on the floor of the NSE, despite sharp decline in the NSE index within the same period.

In addition, The Fund was able to grow its income by about 51% during the period which is a significant leap compared with the decline experienced by other financial institutions and investment schemes. The Fund is therefore able to pay increased distributions during the period and expects to make interim distributions to its subscribers in 2010.

Skye Shelter Fund Announces Change of Name to SFS Real

Estate Investment Trust

The name of Skye Shelter Fund (the Fund) has been changed to SFS Real Estate investment Trust (SFS REIT).

In addition, the Fund's trading symbol was also changed from SKYESHELT to SFSREIT.

The change of name and symbol were implemented by The Nigerian Stock Exchange and the Central Securities Clearing System on Friday, 31 January 2020.

The changes were in compliance with the Unit holder's resolution of 25 October 2019 authorizing the change of name of the Fund.

FAQs

1. What is Skye Shelter Fund?

Skye Shelter Fund is an alternative investment, which pools funds for the primary purpose of investing in income-generating real estate, such as residential homes, shopping malls, offices, warehouses etc while taking advantage of tax exemptions.

A mutual fund/investment vehicle like the Skye Shelter Fund (Skye Shelter) which is set-up for investing in real estate is called a “Real Estate Investment Trust" (REIT). Skye Shelter is Nigeria’s first publicly quoted REIT.

2. What are the types of REITs?

- Equity REITs: These are REITs which invest in/own properties. Revenue generated is primarily from rents received. They provide investors prospective growth from property appreciation and long term capital appreciation when properties are sold.

- Mortgage REITs: These REITs invest in existing mortgages or loan money for mortgages to real estate owners/ real estate projects. Revenue generated is primarily from the interest earned on the mortgage loans.

- Hybrid REITs: These REITs are a combination of both Equity and Mortgage REITs.

3. What does the Skye Shelter Fund invest in?

The Skye Shelter Fund is dedicated to the development and/or acquisition of high quality stock of properties (residential estates, commercial properties and other investment properties) in select locations across Nigeria.

In addition, Skye Shelter will make opportunistic investments in joint venture developments. This will be done in partnership with reputable developers on a case-by-case basis as the Trustees and the Fund Managers may deem fit.

4. What are the unique features of The Skye Shelter Fund as a REIT?

- It invests 75 per cent directly in real estate which may include: residential apartments, shopping malls, office blocks, hotels, warehouses and industrial property;

- It invests 25 per cent in real estate related investments which may include: mortgages, real estate backed securities, real estate related equities. This portion includes a 10% allocation to cash for liquidity purposes.

- It pays out 80 per cent of income, which includes rental income, income from fixed income investments and income from sale of properties. Skye Shelter distributed to its subscribers for every unit held, the sum of N4.65k in 2008 and proposes N7.00k in 2009.

- Income is exempt from Taxation in Nigeria.

- It is organized as a corporate entity/trust which is quoted on the Nigerian Stock Exchange. It has 20,000,000 units of shares at N100.00 per value. It is managed and sponsored by Skye Bank Plc; Its Trustees are PHB Capital & Trust Limited and its external real estate adviser is Ubosi Eleh & Co.

5) How does the Skye Shelter Fund generate profits?

REITS derives profits primarily through income (rents, interest) and disposal of properties. The Fund does not generate income from additional services e.g. property management as this is outsourced.

6) Who invests in REITs?

REITs are attractive to a wide-range of investors through provision of high levels of current income, potential for moderate long term capital appreciation and diversification benefits.

Typical investors are:

- Pension Funds

- Endowment Funds and Foundations

- Insurance Companies

- Bank Trust Units

- Mutual Funds

- Individual Investors

The ₦3 interim dividend in 2010 by the Skye Shelter Fund would imply that the Fund has declared a dividend for 3 years. The Fund manager expects the share to qualify for investment by Pension Fund Administrators (PFAs) with the declaration and payment of the third dividend.

7) What benefits do investors gain from investing in REITs?

Cash flow: Consistent and predictable cash flow generated from rents paid, real estate sold and income from fixed income investments (dividend of N4.65k in 2008 and proposes N7.00k in 2009);

Inflation hedging: Real estate tends to act as an ideal hedge against inflation, increasing in value at a rate faster than inflation over the long term;

Capital Appreciation: The listed share of Skye Shelter Fund can appreciate in price. It is also less volatile than traditional equities.

Portfolio diversification: Real Estate produces returns which behave differently from both stocks and bonds. This low correlation of return provides an added diversification benefit when real estate is added to a multi asset portfolio.

Liquidity: Direct investment in real estate tends to be relatively illiquid. However, this dilemma is resolved by the REIT structure, which enables real estate exposure to be entered and exited freely on the floor of the Nigerian Stock Exchange.

Tax exemption: Recently the Debt Management Office of Nigeria issued a publication exempting all asset backed securities from tax. The tax exemption is expected to cover Personal Income Tax, Value Added Tax, Capital Gains Tax and Companies Income Tax.

8) Who determines the Skye Shelter Fund Investments?

The fund has a 10-man investment committee as follows:

- 4 representatives of the Fund Manager

- 2 Representative of the Trustee

- 2 Independent property experts

- 2 Independent subscribers to the fund

The function of the Investment Committee is to make investment decisions for the fund and review the status and performance of the portfolio periodically (quarterly). A sub-investment committee may be set up to more frequently to implement the decisions of the main investment committee. Summaries of minutes of the meeting of the sub-committee will be distributed to the main committee.

9) How do I invest in the Skye Shelter Fund?

You can purchase units of the Skye Shelter Fund through your stockbroker on the floor of the Nigerian Stock Exchange. You may contact the fund manager using the following details:

Skye Stockbrokers

5th Floor, Skye Bank Building

30 Marina

Lagos

01-7349752, 01-7349753

SFS Financial Services Limited

287 Ajose Adeogun

Victoria Island

Lagos.

skyeshelterfund@sfsnigeria.com

01-2801400

How may we help you?

Email: skyeshelterfund@sfsnigeria.com

Head Office: Plot 287, Ajose Adeogun Street, Victoria Island,

Lagos | Nigeria

Tel: +234 01 2801400, +2348051212046, +2348063266403

Website: www.skyeshelterfund.com

Email: skyeshelterfund@sfsnigeria.com

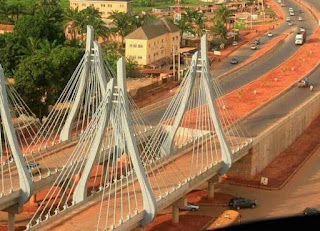

OUR ESTATE LOCATION:

Abuja, Asaba, Enugu, Uyo, Calabar, Port Harcourt, Ibadan, Benin, Warri, Osogbo, Ota, Awka, Owerri, Umuahia, Abakaliki, Epe, Lagos, Abeokuta, Ogun and nationwide

SMS, Call or WhatsApp: 07030765952

bikejoseph@gmail.com

https://joenigeria.blogspot.com

For DailyProperty listing In Uyo

For our products and services

For updated landlistings nationwide

For more information about Joe Nigeria

IBOM E-LIBRARY provides the following rentals services: Conference hall for meetings, summits, workshops, seminars etc. We also have office spaces, Board rooms, a CBT centre, academic and Outdoor spaces for rent Location: Along IBB Way Uyo. Contact: 07030765952

Comments

Post a Comment