5 WAYS TO INVEST IN NIGERIAN REAL ESTATE SECTOR

Maybe you’d like to invest in real estate. You are attracted to the idea of owning a property and earning from it. But you’re wondering how to go about it.

You might be concerned that you don’t have enough money to get involved in this sector. After all, these projects typically cost millions of naira. Or so you think.

Here’s some good news: you don’t have to be immensely wealthy to become a real estate investor. There are relatively inexpensive properties—and ways of investing –that are within your reach.

Here, we’ll go over five ways to invest in real estate, including some options that aren’t as capital intensive as the traditional approaches. If you’re hoping to put some of your money into properties, you should find this article useful.

Ways To Invest In Real Estate

Your path to earning from real estate may involve one or more of the following:

Rental Property

This type of real estate investment focuses on buying a real

estate property, such as an apartment building, and operating it, so you

collect a stream of cash from tenant rent. Cash flow income can be generated by

other types of real estate besides apartment buildings, such as storage units,

office buildings, retail establishments, and rental houses.

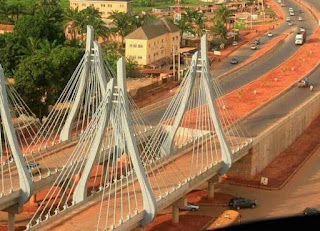

You may choose to build rental property in places with a high demand for residential or commercial space. Fast developing areas of the larger cities in Nigeria are especially good areas to consider for this. Examples include the outskirts of Lagos and Abuja.

But if you consider these areas too expensive, you may explore opportunities in other parts of the country. For instance, you may build a student’s hostel in a University town or apartments in so-called second or third-tier cities and towns (where land and building costs tend to be lower).

Property Flipping

This involves buying land or property, making improvements to it, and reselling it for a profit after a while. You can make money from this when property values appreciate over time; the longer you hold on to the property, the higher the selling price you’re likely to secure.

If you’re looking for a real estate investment with low entry costs, you should try land flipping. It’s especially cheap if you’re doing it outside of the major cities. And if you can flip multiple pieces of land in a short period, you could earn enough to become an even bigger real estate investor.

Crowdfunded Real Estate

Crowdfunded real estate investments are among the least expensive ways to get a share of landed property. You usually don’t need to put in a lot of money.

This sort of opportunity is offered by digital platforms. Users registered on them contribute a minimum amount of money or more; the platform pools these funds together and invests them in properties that yield a significant return for investors.

Platforms in this category include Risevest, Wealth.ng, and Coreum. Although they’ve been around for a while, it’s still a good idea to do your due diligence before placing your funds with them.

Real Estate Investment Trust (REIT)

Real Estate Investment Trusts (REIT) are companies that own or finance income yielding real estate. Their offerings are similar to mutual funds.

Investing in REITs allows you to earn an income from real estate without getting involved in the building or management of the actual property. You can invest in REIT by buying a REIT stock, just the same way you would purchase shares in other companies.

REITs in Nigeria include UPDC Real Estate Investment Trust, Union Homes Real Estate Investment trust, and Sky Shelter Fund.

Loans To Property Flippers

Instead of doing the hard work of flipping property, you may ask a person experienced in this—whom you trust –to do it on your behalf. You could lend that person some money for this purpose, and agree on terms for the payment of returns with them.

In this arrangement, your active partner may also be putting some of their own money into the property flipping business. If it goes well, you could decide to collaborate with them on similar opportunities going forward.

OTHER WAYS OF EARNING FROM REAL ESTATE BUSINES

Real Estate Related Income

This income is generated by specialists in the real estate

industry, such as real estate brokers, who make money from

commissions on properties they have helped a client buy or sell, or real estate

management companies, which get to keep a percentage of rents in exchange for

running the day-to-day operations of a property.

A hotel management company might keep 15% of a hotel's sales

for taking care of the day-to-day operations, such as hiring maids, running the

front desk, mowing the lawn, and washing the towels.

Ancillary Real Estate Investment Income

For some real estate investments, this can be a huge source

of profit. Ancillary real estate investment income includes things such as

vending machines in office buildings or laundry facilities in rental apartment

complexes. In effect, they serve as mini businesses within a bigger real estate

investment, letting you make money from a semi-captive collection of customers.

Final Words

Real estate investments are attractive because they often reward investors with sizeable returns. There are multiple paths to enjoying this benefit; we’ve discussed some of them here. It’s now up to you to choose one that aligns with your goals and budget.

Further reading:

How to buy property in Nigeria

For Daily Property listing In Uyo

For our products and services

For updated land listings nationwide

For more information about Joe Nigeria

Comments

Post a Comment