WHY INVEST IN REAL ESTATE

|

| Why invest in real estate |

Real estate can enhance the risk-and-return profile of an investor’s portfolio, offering competitive risk-adjusted returns. In general, the real estate market is one of low volatility, especially compared to equities and bonds.

Real estate is also attractive when compared with more traditional sources of income return like treasury bills, term deposits and savings accounts.

1. Diversification and Protection

Another benefit of investing in real estate is its diversification potential. Real estate has a low and, in some cases, negative, correlation with other major asset classes—meaning, when stocks are down, real estate is often up. This means the addition of real estate to a portfolio can lower its volatility and provide a higher return per unit of risk. The more direct the real estate investment, the better the hedge: Less direct, publicly traded vehicles, such as REITs, are going to reflect the overall stock market’s performance.

Some analysts think that REITs and the stock market will become more correlated, now that REIT stocks are represented on the S&P 500.

Because it is backed by brick and mortar, direct real estate also carries less principal-agent conflict or the extent to which the interest of the investor is dependent on the integrity and competence of managers and debtors. Even the more indirect forms of investment carry some protection. REITs, for example, mandate that a minimum percentage of profits (90%) be paid out as dividends.

Building a real estate

portfolio over time means that you are securing your own future. Unfortunately,

too many individuals today have no specific plan for how they will secure their

retirement. Real estate investing is not only what some say is the fastest way

to get out of debt but is an undeniable method of creating for yourself

multiple streams of income that will continue well into your retirement years

and can even be passed on to future generations.

If you purchase land

today and come back to it after 30 years, the land will still be intact. This

is because real estate cannot be broken, stolen, or depreciated. You will

most likely meet the asset in a better condition, with an appreciated value.

Now, compare this same scenario with crypto, FOREX or stocks. The volatility

differs. A commodity in the stock market can tank in a matter of weeks, leaving

investors in a no man’s land. This is the most assuring benefit of real estate

investment; it is the best investment option when considering minimal risk.

2. Inflation Hedging

Inflation is the

decline of purchasing power of a given currency over time. In an inflated

market, real estate is your best to maintain a steady income flow and staying

above the general purchasing power. In Nigeria today, today, the interest rates

of savings accounts and fixed deposits interest rates are lower than the

inflation rates. Hence, inflation is a nut every investor is seeking to crack.

The value of real estate/land appreciates against a currency during

inflationary times; this is why it’s a good hedge against inflation. Demand for

land can only increase because it’s a limited resource and cannot be produced.

This could serve as a hedge against inflation as real estate tends to maintain

its value or even appreciate over time despite inflation. These benefits make

real estate investment a major drive for the wealth in maintain wealth even in

a declining economy.

The inflation-hedging capability of real estate stems from the positive relationship between gross domestic product (GDP) growth and demand for real estate. As economies expand, the demand for real estate drives rents higher, and this, in turn, translates into higher capital values. Therefore, real estate tends to maintain the purchasing power of capital, bypassing some of the inflationary pressure on tenants and incorporating some of the inflationary pressure, in the form of capital appreciation.

3. The Power of Leverage

Except for REITs, investing in real estate gives an investor one tool that is not available to the stock market investors i.e. leverage. If you want to buy a stock, you have to pay the full value of the stock at the time you place the buy order—unless you are buying on margin. And even then, the percentage you can borrow is still much less than with real estate, thanks to that magical financing method, the mortgage.

Most conventional mortgages require a 20% down payment. However, depending on where you live, you might find a mortgage that requires as little as 5%. This means that you can control the whole property and the equity it holds by only paying a fraction of the total value. Of course, the size of your mortgage affects the amount of ownership you actually have in the property, but you control it the minute the papers are signed.

This is what emboldens real estate flippers and landlords alike. They can take out a second mortgage on their homes and put down payments on two or three other properties. Whether they rent these out so that tenants pay the mortgage, or they wait for an opportunity to sell for a profit, they control these assets, despite having only paid for a small part of the total value.

Real estate affords

investors access to loans for their projects because real estate can be

used as an asset to secure a loan and could be used as collateral in the loan applications. having an investment that serves as collateral seems like a

smart choice.

4. Tax Benefits.

If you gross N100,000 per year at your nine to five job and I

earn N100,000 per year from my rental property, who gets to keep more after

taxes? You guessed it; my rental property is taxed much lower because the

government rewards rental property owners. The government also offers lower tax

rates on long-term profits along with other benefits like depreciation and the

exclusion of self-employment tax.

5. Cash Flow.

Not

only do real estate investors have the ability to receive a substantial cash

flow from steady wholesale or rehab deals, but they can also ensure themselves

a secure monthly cash flow with rental property deals. The best part about

rental property cash flow is that after all of your bills are paid, the extra

money is considered a passive income. You get to collect a monthly

paycheck, all the while managing the rest of your investing business.

6. Appreciation.

While you are paying off the loan of whatever property you invested in, the value of that property is increasing or appreciating. While things like recessions and market fluctuations are bound to occur, it is safe to say that the value of real estate will increase over an extended period. That being said, any property you purchase today will be worth far more than 30 years from now; however, with a fixed-rate mortgage, you will always be paying the same dollar amount.

Veterans in the industry often invest in real estate property and hold it for a long time. This period of time can range from 8 to 10 years. With the ever-increasing human population and development, investors are guaranteed a good ROI. It is as simple as; if you purchase or invest in real estate property today, its value 15 years from now will be more than the current value.

- Inflow of development

- Increasing population

- Government policies

- low-interest rates etc

7. Control.

Arguably the greatest benefit of starting a real estate business is the control

and pride you feel due to owning something you created. Your

destiny is not tied to an office on Wall Street or your company’s CEO; it only

belongs to you. Real estate investing puts you and you alone in the

driver’s seat of your financial future.

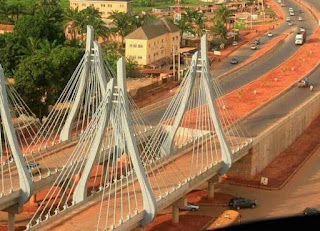

8. Profiting from Area Development

Another benefit of real estate investment are

making a profit from development projects going on around the environment your

property is located is situated. For example, the construction of roads,

hospitals, schools, and estates could have a positive impact on the value of

the land as it will attract residents and investors to the developing

environment making the property more valuable.

9. Little or No Maintenance Costs

Depending on the strategies,

an average FOREX trader monitors the chart at least 5 times daily. Day

traders and scalpers can go as high as 20 times per day. At least

investors who let out properties are saddled with the responsibility of fixing

vandalized facilities, paying maintenance costs, and more while land banking

which is also a form of real estate investment only requires the expense of the

initial purchase of the land and that’s it requires zero maintenance cost.

10. Timeless

Land banking is an

investment that remains profitable over time and can be passed down for

generations, many believe real estate is the only an investment that is

appropriate for achieving generational wealth, therefore individuals who intend

to invest for their kids tend to invest in inland banking as it retains its

initial value and appreciates despite inflations and economic recessions.

11. Real Estate is Improvable

Investments could be risky and out of your control, take for example the stock market; you could purchase stocks hoping to sell them sometime in the future with the aim of making a profit. The appreciation or depreciation of the stock is totally out of your control and solely depends on the success of the company. On the other hand, you can have some control over real estate investments in terms of the physical property and facilities on it, with good management of the overall property one can improve the value and income generated from the investment. A likely instance will be Lagos island, A plot in Sangotedo was selling for 800k as of 2003. Currently, it goes for 30 million nairas. Plots in top estates in Lagos are selling for nothing less than 40-50M, this can help you visualize the potential in real estate

Simple and easy to Understand

Most types of investments

are difficult to comprehend as a lot of them involve abstract ideas and clever

algorithms, which make it difficult for layman to grasp. Considering forex

trading or the stock market, it takes at least 3 months of intensive training

to understand the terminologies involved. Another 2-4 years of demo trading to

fully become independent. This timeline is longer in the stock market which is

why most new traders opt for trading firms, where they end up losing a lot of

money.

The first thing to note about real estate

investment is the simplicity associated with it. It takes about 2-3 weeks to

conduct proper research, verification, or physical inspection required before

making any purchase. It also requires some effort to get the desired result but

is not as complex as other investment options. If you are a new

investor, our ultimate guide to real estate investing for

beginners can help you kickstart your journey in real estate

The Bottom Line

Real estate can be a sound investment and one that has the potential to provide a steady income and build wealth. Still, one drawback of investing in real estate is illiquidity: the relative difficulty in converting an asset into cash and cash into an asset.

Unlike a stock or bond transaction, which can be completed in seconds, a real estate transaction can take months to close. Even with the help of a broker, simply finding the right counterparty can be a few weeks of work. Of course, REITs and real estate mutual funds offer better liquidity and market pricing. But they come at the price of higher volatility and lower diversification benefits, as they have a much higher correlation to the overall stock market than direct real estate investments.

As with any investment, keep your expectations realistic, and be sure to do your homework and research before making any decisions.

Real estate investing for the beginner can really be as conceptually simple as playing Monopoly once you understand the basic factors of investment, economics, and risk. To win, you buy properties, avoid bankruptcy, and generate rent so that you can buy even more properties.

However, keep in mind that "simple" doesn't mean "easy." If you make a mistake, the consequences can range from minor inconveniences to major disasters.

For proof of land ownership in Nigeria

For updated land listings nationwide

For daily property listing in Uyo

More information About Joe Nigeria

Comments

Post a Comment