10 INTERESTING FACTS ABOUT REAL ESTATE IN NIGERIA

Nigeria has a large, vibrant, and growing real estate sector. It features a diversity of property, in terms of style and utility, and a broad range of players, including small informal agencies and large realtor corporations.

If you would like to invest in Nigerian real estate, or you’re just an enthusiast of the space, you’ll want to know a few important facts about it before you get involved. There’s always a lot to learn, but the beginner will do well to acquaint themselves with the basic details that concern the industry.

We provide some of those details, as well as a few little-known ones here.

Here are ten facts about Nigeria’s real estate industry.

An Annual GDP Exceeding ₦2.7 Trillion

According to the National Bureau of Statistics (NBS), Nigeria’s real estate sector output accounted for 6.39% of the country’s GDP in 2020. That’s about ₦2.78 trillion, or $7.3 billion. Its share of national productivity has fluctuated significantly over the past few years.

Housing Deficit Of 22 Million Units

Despite the size of Nigeria’s real estate industry, it’s still not meeting the needs of everyone. The Federal Mortgage Bank of Nigeria says that the country’s housing deficit stands at 22 million units. This is up from the 17 million reported by the PwC a few years earlier.

The World Bank has estimated that Nigeria would need ₦59 trillion in investments to plug its housing deficit. Viewed positively, this is plenty of ground for realtors and property investors to explore.

A 25% Home Ownership Rate

Nigeria has a homeownership rate of 25%. This is lower than its other emerging market counterparts like Turkey (58%), Indonesia (84%), and South Africa (56%). Experts attribute this to the difficulty in obtaining an affordable mortgage.

The FMBN Offers Mortgage Loans At Less Than 6% Annual Interest

Many mortgage and commercial banks in Nigeria provide mortgage loan packages. However, most of these are priced out of the reach of most Nigerians. The Federal Mortgage Bank of Nigeria (FMBN) does offer a relatively low-interest, long-tenured mortgage loan.

Multiple Ways To Invest

There are many ways to invest in real estate. Depending on the funding at your disposal, you may flip land for profit, crowdfund with friends or business partners, or build and rent out residential or office space. Another option would be to invest in a Real Estate Investment Trust (REIT). You can do this by buying a REIT stock.

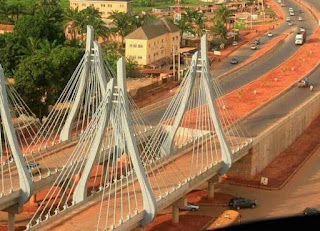

The Most Expensive Properties Are Concentrated In Two Cities

Lagos and Abuja are home to the most expensive lands and properties in Nigeria. Lagos’s Banana Island probably boasts the highest per capita income of any district in the country; it is home to many High Net-Worth Individuals. Old Ikoyi, Ikeja GRA, and Victoria Island are choice locations for wealthy people too.

The FCT has its fair share of exclusive neighbourhoods, with Maitama, Asokoro, and Jabi being prominent on this list.

The Cheapest Lands Are Concentrated In The North

Northern Nigeria has some of the country’s cheapest lands on sale. In states like Katsina, Jigawa, and Bauchi, you can buy a plot of land for as low as ₦70,000 (in certain locations). But there’s plenty of inexpensive land in the South too. You may find an undeveloped plot for less than ₦100,000 in Oyo and Osun states.

FCT Has The Highest Housing Vacancy Rates

According to a report published by Northcourt, a real estate company, the Katampe district has the highest vacancy rate for residential property in the FCT, with about 40% of spaces unoccupied. Apo comes in second with a 19% vacancy rate.

In Lagos, vacancy rates are highest in Victoria Island (22%), and Lekki and Ikoyi (20% each).

Victoria Island Is Lagos’ Most Expensive Location For Retail

On average, retail rents in Victoria Island cost about ₦81,000 per square meter (sqm)—a lot of money by any stretch. Rents for retail spaces in Lekki are just a bit lower; Northcourt says they average about ₦80,000 per square meter.

Rents are far less costly in some other parts of the Lagos metropolis. In Mende, it’s ₦6,000 per sqm. And in FESTAC, it averages ₦7,000 per sqm.

Note that 80% of retail activity in Nigeria happens in Lagos. That’s according to Knight Frank, a UK-based real estate consultancy.

A Growth In Co-Working Spaces

Coworking spaces have been touted as ideal for early-stage tech-dependent businesses and startups. Many real estate investors appear to believe this. Over the past five years, they have channelled more money into building and converting coworking facilities in Nigeria.

In 2016, there were just 29 such spaces in the country. Now, they’re about 138. We’ll likely see more of these locations open up in the coming years, as the startup culture takes off outside of Lagos.

Final Words

The Nigerian real estate scene isn’t problem-free. It’s just as prone to economic trip-ups as other sectors. But it yields a lot of value over the long term. And it’s also a great enabler of economic productivity and prosperity; the spaces it provides are the ones in which most of our wealth is created.

Further Reading:

About real estate investment in Nigeria

For Daily Property listing In Uyo

For our products and services

For updated land listings nationwide

For more information about Joe Nigeria

Comments

Post a Comment