6 AMAZING TIPS ON TURNING REAL ESTATE INTO A REAL FORTUNE

Finding success in

real estate requires more than simply buying low and selling high.

At

least 30 U.S. billionaires made their money from real estate; some say that

it’s the greatest way to create real wealth and financial freedom.

These six tycoons and members of The Oracles suggest how you can invest $100,000 or start with nothing.

TAI LOPEZ

Although

I’m a businessman first, I’ve always been a part-time real-estate investor. You

can do both, too. Have a business or career that creates positive cash flow,

which you can diversify into part-time real estate investing. I’ve done it for

many years.

If you’ve never invested in real estate, start small and don’t use all your money. No one ever looked back and said, “My first deal was my best.” You’ve got to learn how to read the contracts, build your network of specialists—for example, lawyers and realtors—and develop a good eye for it. This only comes from experience.

The

beauty of real estate is that you can learn the ropes while starting small:

find some cheap properties, like single-family homes, renovate-and-flips, multi-units, or commercial properties. Try to commit as little as possible while you

get some notches under your belt. Joel Salatin, my mentor, always said, “Make

your mistakes as small as possible without catastrophic consequences.”

If

you have zero cash, maybe do wholesale deals. A business partner, Cole Hatter,

and I created a real-estate program teaching you how to put a property under

contract for very little money down, sometimes less than $1,000; you sell that

contract to another buyer before the contract expires. Worst case: you just

lose under a grand. Best case: you make $5,000-15,000 positive cash flow that

can be reinvested in long-term holdings. —Tai Lopez, investor and advisor to

many multimillion-dollar businesses, has built an eight-figure online

empire.

GRANT CARDONE

2. Think big.

It’s

easy to give up on the real-estate game because you don’t have any money, but

it’s the deal that matters, not how much money you have. Chase the deal, not

your budget.

I

know a guy who saved $50,000 and started chasing $200,000 deals. First of all,

you can’t buy more than four units with that budget. The problem with four

units is that each can only produce maybe $1,000 or $2,000 per month. And

that’s only after you’ve done thousands of dollars in work around the units to

make them rentable in the first place. That math isn’t difficult—there’s just

not enough money to make it worthwhile.

That’s

why you’ve got to go big from the start—with 16 units, minimum. Don’t buy less.

Without 16 units, you can’t have a manager, and if you can’t have a manager,

you’re going to either dedicate all your attention to the property or to your

full-time job. To get 16 units, you will need to wait and save more money or

use other people’s money (but you’ll need to learn how to sell). —Grant

Cardone, a top sales expert who has built a $500-million real estate empire, and

NYT-bestselling author of “Be Obsessed or Be Average”.

PHIL PUSTEJOVSKY

3. Understand the economics, then find

a mentor.

The

real-estate deals that look the prettiest and are easiest to find—such as

buying a property that has a tenant and management in place, joining a

crowdfunding website, or buying into a publicly-traded real estate investment

trust—yield the lowest returns. The most profitable opportunities are the ones

no one else knows about, which you find and create.

Due

to a strong economy, high consumer confidence, historically low inventory

levels, and extremely low-interest rates, it’s the best time to flip houses in

the past 40 years.

High consumer confidence and a strong economy give retail buyers the feeling that “now is a good time to buy” rather than retreat in fear and continue renting. Low-interest rates allow retail buyers to purchase more of a home than if the rates were at historical average levels, like 6 per cent. Low inventory levels create bidding wars by retail buyers, which increase the prices that investors sell their flipped houses for.

So,

if you can find the deals before the competition, you can transform a little

bit of money into a whole lot in a relatively short period by flipping houses.

If

you’re seeking tax-advantaged passive income, thanks to the rise of the sharing

economy and services like Airborne and Home Away, short-term renting of

residential properties is producing the highest returns. (It’s not uncommon to

obtain more than a 20 per cent return on very nice properties in beautiful

areas.) The majority of my real-estate holdings are now in short-term rentals.

Unfortunately,

real estate is full of pitfalls. Getting educated through reputable online

sources can help, but an article, book, or how-to video will be of little

assistance in answering the most important questions you’ll have in the heat of

a deal. That’s where the right real estate mentor becomes an invaluable

resource. —Phil Pustejovsky, founder of Freedom Mentor, bestselling author of

“How to be a Real Estate Investor”, and #1 YouTube channel on real estate

investing with nearly 20 million views.

MARK BLOOM

Before

throwing money away on the HGTV pipe dream, educate yourself! Don’t spend

thousands of dollars on coaches and seminars. No matter how shiny they make it

or how much you’re told you need an expensive education, you don’t. Information

is inexpensive and plentiful. Find it or someone specializing in investment

real estate, like me.

Holding assets is the way to build wealth through real estate. The shelter is a basic need. Dirt, in and around major metro areas, is a finite resource, and demand is constantly increasing. By owning a rental on that dirt, you have a small business that works to pay off your mortgage. Flipping is over glamorized, in my opinion. Rent and hold for the win.

Boomers

and millennials want smaller housing, closer to cities. Additionally,

real-estate investors commoditizing American suburbs and re-gentrification has

pushed lower-income families out. Because of this, America’s suburbs have seen

a 57 per cent increase of people living below the poverty level in the last 15

years. Buy your cities.

Don’t

blow your budget. Most projects have surprises or overruns; it’s just part of

the business. Keep a cushion for the unexpected. Lever your funds to increase

returns and reduce risk. Start with one project. Get your model set, tweak,

then buy two. Continue and progress until you build a solid portfolio.

Educate

yourself, hustle, and create value. Take massive, determined action daily. Talk

to brokers, call contractors, view open houses, and go to meetups. Learn! And

when you’re ready, door knock! The best deal is the one that isn’t for sale.

Find it, then find someone like me and close it down. —Mark Bloom, President at

NetWorth Realty.

COM MIRZA

5. Start today.

In

building over $100 million in real estate, I’ve personally used three

strategies many times.

One:

Purchase a low-income property, typically for $35,000 to $55,000. Costs are low

but yields are consistent. Hand over all management to a third-party company,

and collect your monthly rent passively, bringing in annual returns of 8 per cent to 10 per cent. If you purchase two to three properties like this per

year, you will have a portfolio of 20 to 30 in a decade.

Two: If you can fix things yourself, do a “live-in flip.” Buy a house that needs a little work at a great deal; live in it for one or two years while you rehab it. Then flip the house for an appreciated value and profit. Doing this five times in 10 years could generate $300,000 to $500,000 net profit. That would let you buy your own house in cash! Or reinvest into rental properties, which would cover your cost of living anywhere in the world.

Three:

Joint venture on a deal. People have money; they just need the right

opportunity. Find a good deal and tie up the property with a contractual

clause, pending financing approval within 30 days. Then find another investor

to partner on the flip with you. Explain that you secured the property and just

need the funds for a specific period, and the return will be split between you

both.

Make

enough calls, and you’ll find a joint venture partner easily. Just ensure you

correctly calculate the cost of rehab and expected sale price. Most people

mistakenly underestimate the rehab cost and overestimate the sale price,

killing their margins. — Com Mirza, “The $500 Million Man” and CEO of Mirza

Holdings; failed in eight companies back to back and today, runs a nine-figure

empire with over 600 employees.

ROY MCDONALD

6. Profit is in the purchase.

Source

transactions that contain some core elements: they take the shortest amount of

time to complete, and provide the maximum amount of profit while minimizing

risk and the amount of cash you invest initially.

Before

really embarking, solidify your A-Team (advisors whose opinions you trust) and B

Team (associates who turn the gears).

Once you have a plan, pull the trigger. Don’t just have a backup plan—ensure that even the most airtight scheme has at least five exit strategies. Experience has taught me that the winds of a favourable real estate market can shift rapidly; the last thing you want is to be anchored to a dozen unsalable investments.

Finally,

know the difference between buying, holding, and trading. Buying is a no

brainer, but it’s what you do with a property that determines your success. My

primary strategy has been holding onto the commercial real estate for the long term

and trading out residential pretty quickly. Know your market. —Roy McDonald,

founder and CEO of One Life.

Source: entrepreneur.com, Slide Share, Investopedia

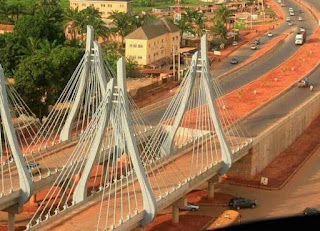

OUR ESTATE LOCATION:

Abuja, Asaba, Enugu, Uyo, Calabar, Port Harcourt, Ibadan, Benin, Warri, Osogbo, Ota, Awka, Owerri, Umuahia, Abakaliki, Epe, Lagos, Abeokuta, Ogun and nationwide

SMS, Call or WhatsApp: 07030765952

bikejoseph@gmail.com

https://joenigeria.blogspot.com

For DailyProperty listing In Uyo

For our products and services

For updated landlistings nationwide

For more information about Joe Nigeria

IBOM E-LIBRARY provides the following rentals services: Conference hall for meetings, summits, workshops, seminars etc. We also have office spaces, Board rooms, a CBT centre, academic and Outdoor spaces for rent Location: Along IBB Way Uyo. Contact: 07030765952

Comments

Post a Comment