TYPES OF MORTGAGE AND HOW THEY IMPACT YOUR FINANCES

Introduction

You probably clicked on

this link because you’re interested in owning a home. Maybe now or somewhere

down the line but everyone wants a home, we all want to get the burden of

annual or monthly rent off our bill and realise our homeownership dreams.

Well, except you come

upon a huge cash windfall, earn more than the average income-earner or you’re

an uber-successful businessperson, you need to plan extensively and weigh all

your options before embarking on a housing project.

Funding a home is no

easy feat and most individuals require debt instruments to execute such

projects in good time. The most common instrument among these is Mortgage which

guarantees the borrower a sum of money to make the real estate purchase and the

debt is serviced over a while. In return, the property is pledged to

the lender who is reserved the right to foreclose the asset in the event of a

failure of the borrower to fulfil the contractual agreement.

Notwithstanding this

point, which might appear like a downside, a mortgage is largely favoured by real

estate investors due to the large funds it affords and its long-term repayment

flexibility, these are two things personal loans, on the other hand, do not

guarantee.

Even though a mortgage has

its fair share of pros and cons, there are salient facts about it that

prospective lenders must know before utilising this option and like every kind

of loan, extensive consideration must be paid to the interest. To further

improve your understanding of the subject matter, we have shed more light on

the popular mortgage types below:

Fixed-rate/traditional mortgage:

This type of mortgage

guarantees that the borrower pays a fixed rate over a certain period; which

could be short-term, mid-term or long-term. This mortgage is insusceptible to

the fluctuations of the money market nor the oscillation of inflation. That is,

if you get a 30-year fixed-rate mortgage in 2020 at 6%, you will keep repaying

it at that same rate until completion in 2050. Regardless of market interest

rates, your mortgage rate change. To give our customers top-of-the-class

services, we also offer this type of mortgage.

Adjusted-rate mortgage (ARM):

Here, the lender pays

the mortgage at a fixed rate for a predetermined time and upon the termination

of that time, the rate reverses to the going market interest rates. Simply put,

under these terms, a 10-year loan obtained in 2020 will be repaid at a fixed rate for a time, say 5 before the adjusted-rate terms kick in and it

becomes subject to the going market interest rate. This type of mortgage is generally

not considered the best because a borrower may end up paying double the loan

amount based on the stability, or lack thereof, of the money market in the

country. Generally, the initial rate of an ARM is often lower than a fixed-rate

mortgage because chances are that it will surpass it in the long run. It also

has less stringent qualification criteria.

Interest-only mortgage:

The least popular of the trio and commonly

avoided is the interest-only mortgages. They are often structured in two

parts: the first where you pay the interest on the mortgage alone and the

second where your pay both the principal (amount loaned) and interest at a

variable rate that could be as high as three times the amount borrowed. For

instance, a 30-year interest-only mortgage at a 10% rate begins with the borrower

paying only the interest for a certain time, say 10, before the switch to the

repayment of both principal and variable interest.

Begin your homeownership journey today!

Source: Green Park Estate

Further reading:

Definition of mortgage, types and examples

OUR ESTATE LOCATION:

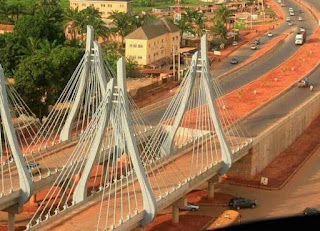

Abuja, Asaba, Enugu, Uyo, Calabar, Port Harcourt, Ibadan, Benin, Warri, Osogbo, Ota, Awka, Owerri, Umuahia, Abakaliki,

Epe, Lagos, Abeokuta, Ogun and nationwide

SMS, Call or WhatsApp: 07030765952

bikejoseph@gmail.com

https://joenigeria.blogspot.com

For DailyProperty listing In Uyo

For our products and services

For updated landlistings nationwide

For more information about Joe Nigeria

IBOM E-LIBRARY provides the following rentals services: Conference hall for meetings, summits, workshops, seminars etc. We also have office spaces, Board rooms, a CBT centre, academic and Outdoor spaces for rent Location: Along IBB Way Uyo. Contact: 07030765952

Comments

Post a Comment